As the popularity of cryptocurrencies continues to grow, so does the risk of falling victim to scams and fraudulent schemes. One such scam that has been causing concern is the Zyber Swaps crypto scam. In this article, we will dive into the details of this scam and provide you with valuable information on how to protect your investments.

Zyber Swaps, touted as a cryptocurrency investment platform, has been targeting unsuspecting investors with the promise of high returns and guaranteed profits. However, upon closer inspection, it becomes evident that Zyber Swaps is nothing more than a fraudulent operation designed to deceive and defraud individuals.

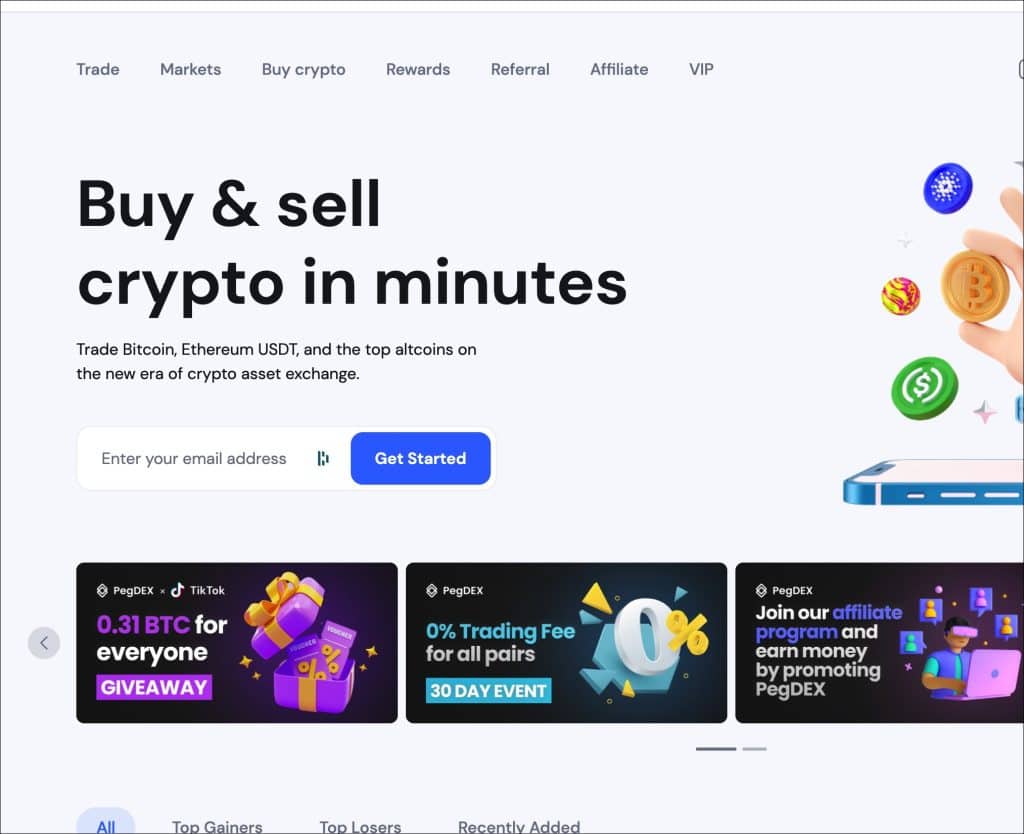

The Zyber Swaps crypto scam operates by luring investors with the allure of easy money and promising significant returns on their investments. They present themselves as a legitimate platform, complete with a whitepaper and a professional-looking website at zyber-swaps.com. However, it is crucial to note that this platform is a scam and engaging with it puts your investments at great risk.

Investors who have fallen victim to the Zyber Swaps scam have reported significant financial losses and the inability to recover their funds. The lack of transparency and regulation surrounding the crypto industry makes it easier for scammers like Zyber Swaps to operate unchecked.

To protect yourself from falling victim to the Zyber Swaps crypto scam, it is essential to educate yourself about the warning signs and take proactive measures. In the following sections of this article, we will explore the types of crypto scams, the red flags to watch out for, and how to report and avoid scams effectively.

Remember, your investments are valuable, and it is crucial to be vigilant and informed to safeguard them in the evolving world of cryptocurrencies.

Understanding Crypto Scams

When it comes to investing in cryptocurrencies, it is essential to be aware of the various scams that exist in the crypto space. Crypto scams can take different forms and target individuals who are looking to enter the world of digital assets. By understanding these scams, you can better protect yourself from falling victim to fraudulent schemes.

Some common types of crypto scams include:

- Investment scams: These scams entice individuals with promises of high returns on their investments but ultimately result in financial losses.

- Phishing scams: Scammers use deceptive tactics, such as fake websites or emails, to trick users into providing their sensitive information, including passwords and private keys.

- Upgrade scams: Scammers pose as legitimate cryptocurrency projects and encourage users to upgrade their wallets or software, only to steal their funds.

- SIM-swap scams: Scammers gain control of a user’s mobile phone number through social engineering techniques and use it to gain unauthorized access to their crypto accounts.

- Fake crypto exchanges and wallets: Scammers create fake exchange platforms or wallets that appear legitimate but are designed to steal users’ funds.

Being aware of these types of scams is the first step in safeguarding your investments. By staying informed and exercising caution, you can protect yourself from falling victim to cryptocurrency scams.

The Risks of Crypto Investments

Investing in cryptocurrencies comes with its fair share of risks. The cryptocurrency market is highly volatile and not regulated by a central authority, which exposes investors to various uncertainties and potential scams. Understanding these risks is crucial in safeguarding your investments and making informed decisions.

Lack of Regulation

One of the major risks of crypto investments is the lack of regulation in the industry. Unlike traditional financial markets, cryptocurrencies operate in a decentralized and unregulated environment. This lack of oversight can make it challenging to assess the legitimacy of projects and increases the chances of falling victim to fraud or scams.

Technological Complexity

The technological complexity of cryptocurrencies can pose risks for investors. Understanding how blockchain technology works and managing digital wallets requires a certain level of technical knowledge. If investors are not well-versed in these concepts, they may make mistakes or fall prey to phishing attacks, resulting in the loss of their investments.

Rapid Industry Growth

The rapid growth and evolving nature of the cryptocurrency industry also contribute to the risks associated with crypto investments. New cryptocurrencies and projects emerge regularly, making it challenging to differentiate between legitimate opportunities and scams. Additionally, the volatile nature of the market can lead to significant price fluctuations, potentially resulting in financial losses for investors.

By being aware of these risks and taking appropriate precautions, such as conducting thorough research, diversifying your portfolio, and only investing what you can afford to lose, you can mitigate the potential pitfalls of crypto investments and protect your assets.

Common Types of Crypto Scams

Crypto scams come in various forms, but they can broadly be categorized into two main types: access scams and manipulation scams. Understanding the tactics used by scammers is essential in identifying and avoiding potential risks to your cryptocurrency investments.

Access Scams

Access scams target individuals by attempting to gain unauthorized access to their digital wallets or private keys. Scammers may use deceptive techniques such as phishing emails, fake websites, or malware to trick unsuspecting users into revealing their sensitive information. Once scammers have access to your wallet or private keys, they can transfer your cryptocurrencies to their own accounts, resulting in significant financial losses.

Manipulation Scams

Manipulation scams involve persuading individuals to transfer their cryptocurrencies directly to scammers. These scams often promise unrealistic guarantees of high returns or special investment opportunities. Scammers may employ various tactics, such as out-of-the-blue contact, celebrity impersonation, romance scams, or free offers, to gain the trust of potential victims. Once scammers have convinced individuals to make the transfer, the cryptocurrencies are irretrievable, and victims suffer financial losses.

It is important to remain vigilant and be aware of the common tactics used by scammers. Some red flags to watch out for include guarantees of high returns, unsolicited and unexpected contact, celebrity impersonation, romantic interactions combined with investment advice, and offers that sound too good to be true. Lack of transparency, business impersonation, and fake job opportunities are also common tactics used by scammers.

Remember: Always exercise caution and conduct thorough research before engaging in any cryptocurrency transactions. Be skeptical of promises of guaranteed profits and stay away from offers that require you to disclose sensitive information or transfer your cryptocurrencies without proper verification.

Recognizing Crypto Scams

Recognizing crypto scams is crucial in protecting yourself from becoming a victim. By being aware of the red flags associated with these scams, you can avoid falling prey to fraudulent schemes and safeguard your investments. Here are some key indicators to watch out for:

- Payment Demands in Cryptocurrency: Scammers often demand payment exclusively in cryptocurrency, making it difficult to track and recover funds.

- Promises of Guaranteed Profits: Be cautious of any investment opportunity that guarantees high returns with little to no risk. Remember, no investment is risk-free.

- Investment Advice Blended with Online Dating Interactions: Scammers may try to build a false sense of trust by engaging in online dating interactions while offering investment advice. Be wary of such interactions and separate romance from financial decisions.

- Requests for Cryptocurrency Keys: Legitimate entities will never ask you to share your cryptocurrency keys. If someone requests this information, it is likely a scam.

- Dubious Texts or Emails Impersonating Reputable Entities: Be cautious when receiving texts or emails that claim to be from well-known organizations or individuals. Verify the sender’s authenticity before taking any action.

- Blackmail Attempts: Scammers may attempt to blackmail individuals involved in cryptocurrency transactions by leveraging explicit materials. Never share personal or compromising information with strangers online.

By remaining vigilant and staying informed about these red flags, you can protect yourself from falling victim to crypto scams and ensure the security of your investments.

How to Report Crypto Scams

If you have fallen victim to a crypto scam, it is essential to report it to the appropriate authorities. Reporting these scams not only helps protect yourself but also contributes to the overall fight against crypto fraud. The following institutions are key channels for reporting crypto scams:

- Federal Trade Commission (FTC): The FTC actively investigates and takes action against deceptive and fraudulent activities. Reporting a crypto scam to the FTC can help in raising awareness and assisting in legal actions.

- Securities and Exchange Commission (SEC): The SEC plays a critical role in regulating the securities market and protecting investors. Reporting a crypto scam to the SEC helps in their enforcement efforts and helps prevent future scams.

- Commodity Futures Trading Commission (CFTC): The CFTC enforces regulations in the commodities market, including cryptocurrencies. Reporting a crypto scam to the CFTC can assist in their efforts to combat fraudulent activities.

- Internet Crime Complaint Center (IC3): The IC3 is a partnership between the FBI, the National White Collar Crime Center (NW3C), and the Bureau of Justice Assistance (BJA). Reporting a crypto scam to the IC3 helps in their efforts to investigate and pursue cybercriminals.

By reporting crypto scams to these authorities, individuals can contribute to the fight against fraudulent activities and raise awareness to protect others in the crypto community.

How to Avoid Crypto Scams

When it comes to safeguarding your crypto investments, it’s crucial to follow best practices as a crypto investor. By staying vigilant and taking proactive measures, you can protect yourself from falling victim to crypto scams. Here are some key strategies to keep in mind:

1. Don’t Respond to Unsolicited Contact

Avoid engaging with unsolicited emails, messages, or phone calls that claim to offer lucrative investment opportunities or ask for personal information. Legitimate companies and service providers will not reach out to you in this manner.

2. Check Before Clicking

Always exercise caution when clicking on links or downloading attachments. Verify the source and legitimacy of the website or communication before taking any action. Be particularly careful with links or emails that seem too good to be true or provide unexpected offers.

3. Keep Your Accounts Separate

For added security, keep your cryptocurrency accounts separate from your personal accounts. Create unique usernames and passwords for your crypto-related platforms and wallets to minimize the risk of unauthorized access.

4. Place a Hold on Unusual Activity

If you notice any unusual or suspicious activity in your crypto accounts, such as unauthorized transactions or unrecognized logins, promptly place a hold on your account and report the incident to the platform or wallet provider. Taking immediate action can help mitigate potential damage.

5. Use Reputable Companies

When engaging in crypto transactions, choose reputable and well-established companies and platforms. Research their reputation, security measures, and user reviews to ensure you are dealing with trusted entities.

6. Look for HTTPS

When visiting websites related to cryptocurrencies, always check for the presence of HTTPS in the website URL. The “s” in HTTPS indicates a secure connection, which helps protect your sensitive information from being intercepted by hackers.

“To avoid falling victim to scams, it is crucial for crypto investors to exercise caution, be vigilant, and follow best practices. By taking these proactive steps, you can safeguard your investments and reduce the risk of falling prey to fraudulent schemes.”

| Best Practices to Avoid Crypto Scams | Key Points |

|---|---|

| Don’t Respond to Unsolicited Contact | Avoid engaging with unsolicited emails, messages, or phone calls that claim to offer lucrative investment opportunities or ask for personal information. |

| Check Before Clicking | Exercise caution when clicking on links or downloading attachments. Verify the source and legitimacy of the website or communication before taking any action. |

| Keep Your Accounts Separate | Create unique usernames and passwords for your crypto-related platforms and wallets to minimize the risk of unauthorized access. |

| Place a Hold on Unusual Activity | If you notice any unusual or suspicious activity in your crypto accounts, promptly place a hold on your account and report the incident. |

| Use Reputable Companies | Choose reputable and well-established companies and platforms for your crypto transactions. |

| Look for HTTPS | Ensure websites related to cryptocurrencies have HTTPS in the URL to protect your sensitive information. |

Safeguarding Your Crypto Investments

In the world of cryptocurrency, it is crucial to take steps to safeguard your investments from potential scams and fraud. By implementing the following measures, you can protect your assets and ensure a secure investment journey.

Secure Your Digital Wallets

Your digital wallets are the gateways to your crypto assets, making it essential to prioritize their security. Use reputable and trusted wallets that offer robust security features, such as encryption and multi-factor authentication. Keep your wallet software up to date to protect against any vulnerabilities that may be exploited by hackers.

Use Reputable Exchanges

When trading or investing in cryptocurrencies, it is important to choose reputable exchanges. Research and select exchanges that have a proven track record, strong security measures, and regulatory compliance. Be cautious of lesser-known exchanges and do thorough research before engaging with them.

Enable Two-Factor Authentication

Enable two-factor authentication (2FA) wherever possible to provide an additional layer of security for your crypto transactions. Two-factor authentication requires you to verify your identity through a second device or application, such as a mobile phone or authenticator app, before accessing your accounts.

Avoid Public Wi-Fi for Crypto Transactions

Public Wi-Fi networks can be vulnerable to attacks and may expose your sensitive information, including your crypto transactions. It is best to avoid using public Wi-Fi when conducting any crypto-related activities. Instead, opt for secure and private networks, such as your home or trusted cellular data networks.

Keep Software and Antivirus Programs Up to Date

Regularly update your operating system, wallet software, and antivirus programs to ensure you have the latest security patches and protections against malware and viruses. Cybercriminals continually evolve their tactics, so it is crucial to stay ahead with up-to-date software.

Conduct Thorough Research Before Investing

Before investing in any cryptocurrency project or token, conduct thorough research to understand its legitimacy and potential risks. Pay attention to the project’s team, whitepaper, community, and regulatory compliance. Look for reliable sources of information and seek advice from trusted experts in the field.

By implementing these safeguarding measures, you can significantly reduce the risk of falling victim to crypto scams and protect your valuable investments. Stay vigilant, stay informed, and enjoy a secure journey in the world of cryptocurrency.

| Safeguarding Your Crypto Investments | Key Measures |

|---|---|

| Secure Your Digital Wallets | Use reputable wallets, update software, and enable multi-factor authentication. |

| Use Reputable Exchanges | Choose exchanges with strong security measures and regulatory compliance. |

| Enable Two-Factor Authentication | Add an additional layer of security for your crypto transactions. |

| Avoid Public Wi-Fi for Crypto Transactions | Protect sensitive information by avoiding public Wi-Fi networks. |

| Keep Software and Antivirus Programs Up to Date | Regularly update your software for the latest security patches. |

| Conduct Thorough Research Before Investing | Understand the legitimacy and potential risks of the project or token. |

Understanding the Nature of Crypto Scams

The rise of cryptocurrencies has brought about not only revolutionary changes but also new risks and challenges. It is crucial to understand the nature of crypto scams to safeguard your investments and protect yourself from fraudulent schemes. Crypto scams exploit various unique characteristics of cryptocurrencies, including:

- Privacy Risks: Cryptocurrencies offer a certain level of anonymity, making it attractive to scammers who can hide their identities behind complex blockchain networks.

- Irreversibility of Transactions: Once a cryptocurrency transaction is confirmed on the blockchain, it becomes virtually impossible to reverse, leaving victims with little to no recourse in the event of a scam.

- Lack of Regulation: The decentralized nature of cryptocurrencies means that there is no central authority overseeing transactions, leading to a lack of regulatory framework and increased vulnerability to scams.

- Technological Complexity: The intricate technical aspects of cryptocurrencies, such as private keys and digital wallets, can be confusing and intimidating, making individuals susceptible to scams.

- High Profit Potential: The promise of substantial returns attracts investors, but it also attracts scammers who exploit this desire for financial gain.

- Rapid Industry Growth: The fast-paced nature of the cryptocurrency industry provides scammers with opportunities to take advantage of unsuspecting investors.

By understanding these factors, you can better identify red flags, stay vigilant, and protect yourself from falling prey to crypto scams.

“Investors need to be aware of the risks associated with cryptocurrencies and educate themselves about the potential dangers of crypto scams. Awareness and vigilance are key to protecting your investments in this rapidly evolving industry.” – Crypto Expert

Characteristics of Crypto Scams

| Characteristics | Description |

|---|---|

| Privacy Risks | Scammers leverage the anonymity of cryptocurrencies to hide their identities and carry out fraudulent activities. |

| Irreversibility of Transactions | Once a cryptocurrency transaction is confirmed, it cannot be reversed, leaving victims with little recourse. |

| Lack of Regulation | The decentralized nature of cryptocurrencies means there is no central authority to regulate transactions, making them vulnerable to scams. |

| Technological Complexity | The technical aspects of cryptocurrencies, such as private keys and digital wallets, can be confusing and exploited by scammers. |

| High Profit Potential | Scammers entice victims with promises of significant returns on investments, leveraging the allure of financial gain. |

| Rapid Industry Growth | The fast-paced nature of the cryptocurrency industry provides scammers with ample opportunities to exploit unsuspecting investors. |

Understanding the nature of crypto scams is essential for anyone involved in the cryptocurrency market. By staying informed and adopting a cautious approach, you can safeguard your investments and navigate the crypto landscape securely.

The Impact of Crypto Scams

Crypto scams have a profound impact on both individual investors and the crypto market as a whole. These scams cause significant financial losses for victims, erode trust in the crypto market, and damage the reputation of legitimate projects. Additionally, they attract regulatory scrutiny, leading to potential regulatory measures to prevent further scams.

Financial Losses

One of the most direct impacts of crypto scams is the financial losses suffered by individuals who fall victim to these fraudulent schemes. Scammers often convince investors to transfer their hard-earned money or valuable cryptocurrencies, resulting in devastating financial consequences.

Erosion of Trust in the Crypto Market

Crypto scams undermine trust in the crypto market as a whole. When investors become victims of scams, it creates a sense of skepticism and caution among others who may be considering investing in cryptocurrencies. The erosion of trust can hinder the growth and adoption of legitimate crypto projects.

Damage to the Reputation of Legitimate Projects

Crypto scams not only harm individual investors but also tarnish the reputation of legitimate projects in the crypto industry. Scammers often take advantage of the buzz and excitement surrounding new projects, using similar branding or false promises to deceive investors. As a result, genuine projects may suffer reputational damage and struggle to regain trust.

Regulatory Scrutiny

The prevalence of crypto scams has attracted regulatory scrutiny from government agencies and financial authorities. Regulators are keen on protecting investors and ensuring the integrity of the financial markets. As a response to these scams, regulatory measures may be implemented to enhance investor protection, such as stricter regulations and enforcement actions against fraudulent players.

To combat the negative impact of crypto scams, it is crucial for investors to remain vigilant, educate themselves about potential scams, and report any suspicious activities to the appropriate authorities. Additionally, industry stakeholders should work together to promote transparency, establish best practices, and raise awareness about the risks associated with crypto investments.

Educating Yourself and Others about Crypto Scams

When it comes to protecting yourself and others from crypto scams, education is key. By raising awareness, sharing experiences, supporting legislation against scams, and promoting safe investment practices, we can create a safer crypto investment environment for everyone.

One of the most effective ways to combat crypto scams is by educating yourself about the red flags and warning signs. Stay informed about the latest scams and tactics used by fraudsters to target unsuspecting investors. By familiarizing yourself with these scams, you can better protect your investments and make informed decisions.

Sharing your experiences with others is another powerful way to raise awareness and educate the community. By openly discussing scam incidents and sharing lessons learned, you can help others avoid falling victim to similar schemes. Together, we can create a network of informed investors who can support and protect one another.

In addition to individual efforts, it is important to support legislation against crypto scams. Lobby for stricter regulations and enforcement measures to hold scammers accountable for their fraudulent activities. By advocating for stronger legal frameworks, we can deter scammers and ensure a safer investment landscape.

Promoting safe investment practices is crucial in preventing fraud. Encourage others to conduct thorough research before investing, always verify the legitimacy of a project or platform, and be cautious of unrealistic promises of high returns. By promoting responsible and informed investing, we can minimize the risk of falling victim to scams.

By educating yourself and others about crypto scams, raising awareness, sharing experiences, supporting legislation against scams, and promoting safe investment practices, we can work together to create a more secure and trustworthy crypto ecosystem.

Conclusion

In conclusion, safeguarding your investments from scams like the Zyber Swaps crypto scam requires a combination of awareness, education, and proactive measures. Understanding the nature of these scams and recognizing red flags are essential steps towards protecting your assets. By staying informed, you can minimize the risk of falling victim to fraudulent schemes in the evolving world of cryptocurrency.

It is crucial to report any incidents of crypto scams to the appropriate authorities, such as the Federal Trade Commission, Securities and Exchange Commission, Commodity Futures Trading Commission, or the Internet Crime Complaint Center. Reporting these scams not only helps raise awareness but also contributes to mitigating future criminal activities.

To further protect your investments, take proactive steps like securing your digital wallets, using reputable exchanges, enabling two-factor authentication, and avoiding public Wi-Fi for crypto transactions. Keeping software and antivirus programs up to date and conducting thorough research before investing are also crucial in safeguarding your assets.

In the ever-changing landscape of cryptocurrencies, protecting your investments is of utmost importance. By staying vigilant, informed, and taking proactive measures, you can safeguard your assets from the Zyber Swaps crypto scam, as well as other crypto scams. Invest wisely and protect your hard-earned money in the world of digital currencies.

FAQ

What is the Zyber Swaps crypto scam?

The Zyber Swaps crypto scam is a fraudulent scheme targeting unsuspecting investors in the cryptocurrency market. It is important to be aware of this scam and take steps to protect your investments.

What are the common types of crypto scams?

Common types of crypto scams include investment scams, phishing scams, upgrade scams, SIM-swap scams, and fake crypto exchanges and wallets. Understanding these scams is crucial in safeguarding your assets.

What are the risks of crypto investments?

Crypto investments come with inherent risks due to the lack of regulation, technological complexity, and rapid industry growth. It is important to be aware of these risks and take precautions when engaging in crypto investments.

What are the red flags to look out for in recognizing crypto scams?

Red flags in recognizing crypto scams include payment demands exclusively in cryptocurrency, promises of guaranteed profits, investment advice blended with online dating interactions, requests for cryptocurrency keys, and receipt of dubious texts or emails impersonating reputable entities.

How can I report a crypto scam?

If you have fallen victim to a crypto scam, it is important to report it to the appropriate authorities such as the Federal Trade Commission, Securities and Exchange Commission, Commodity Futures Trading Commission, or the Internet Crime Complaint Center.

What are some best practices for avoiding crypto scams?

Best practices for crypto investors include not responding to unsolicited contact, checking before clicking on links or attachments, keeping accounts separate, placing a hold on unusual activity, using reputable companies, and looking for HTTPS in website URLs.

How can I safeguard my crypto investments?

Safeguarding your crypto investments involves securing your digital wallets, using reputable exchanges, enabling two-factor authentication, avoiding public Wi-Fi for crypto transactions, keeping software and antivirus programs up to date, and conducting thorough research before investing.

What factors contribute to the nature of crypto scams?

The nature of crypto scams is influenced by factors such as privacy risks, irreversibility of transactions, lack of regulation, technological complexity, high profit potential, and rapid industry growth.

What is the impact of crypto scams?

Crypto scams have a significant impact on both individual investors and the crypto market as a whole. They result in financial losses for victims, erosion of trust in the crypto market, damage to the reputation of legitimate projects, and increased regulatory scrutiny.

How can I educate myself and others about crypto scams?

Educating yourself and others about crypto scams can be done through raising awareness, sharing experiences, supporting legislation against scams, and promoting safe investment practices.

How can I protect my investments from the Zyber Swaps crypto scam?

To protect your investments from the Zyber Swaps crypto scam, as well as other crypto scams, it is important to be aware, educated, and proactive. Understand the nature of these scams, recognize red flags, report incidents, and take measures to safeguard your investments.